Branta - Building Trust in Bitcoin Transactions

Branta - Building Trust in Bitcoin Transactions

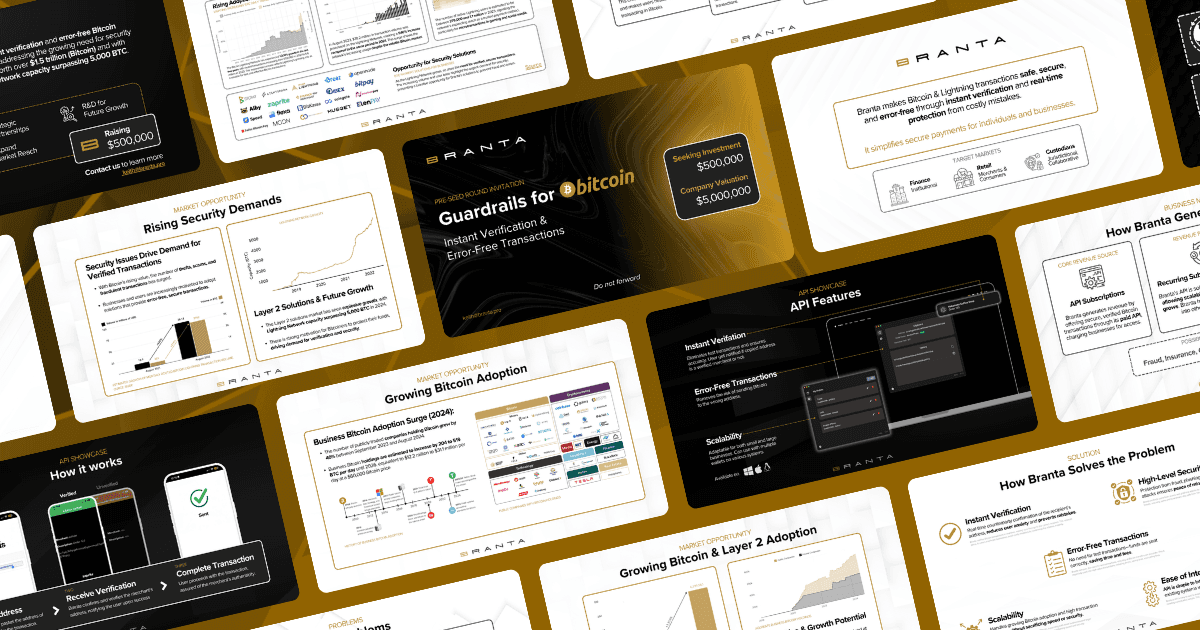

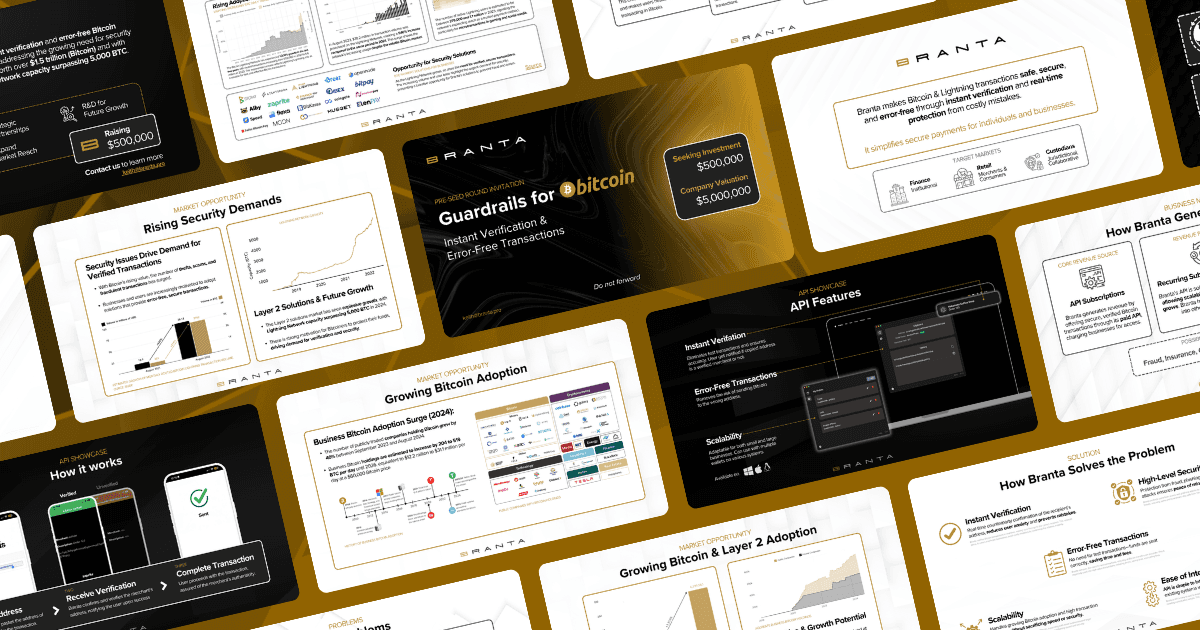

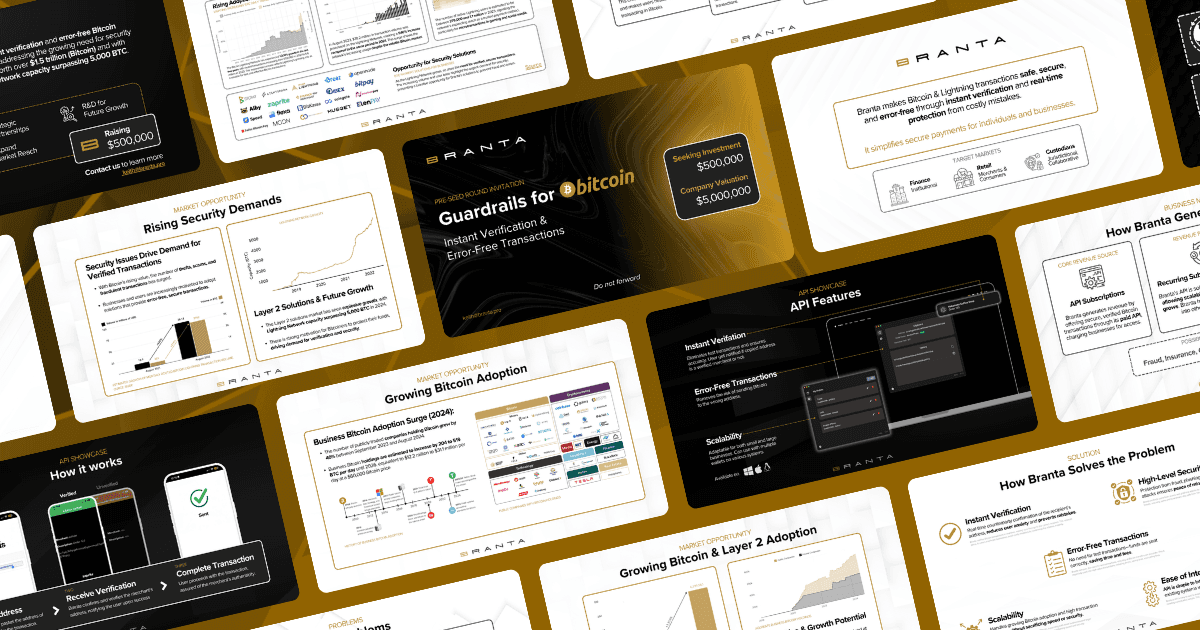

Crafting a Pitch Deck That Speaks to Investors’ Real Concerns

Crafting a Pitch Deck That Speaks to Investors’ Real Concerns

Imagine sending a high-value Bitcoin transaction—only to find out it went to the wrong address. No customer service, no chargebacks, just irreversible loss. That’s the anxiety gripping the world of crypto transactions today. Enter Branta, a game-changing solution designed to make Bitcoin and Lightning transactions stress-free and secure.

With a pre-seed goal of raising $500,000 at a $5 million valuation, Branta is on a mission to protect users from costly errors and fraud in the fast-growing world of digital finance. This pitch deck doesn’t just present an idea; it lays out a clear solution, backed by a solid revenue model and a surge in demand for Bitcoin verification. Dive in, and you’ll find actionable insights on crafting a pitch deck that speaks directly to investors’ concerns, showcases real-world solutions, and highlights a compelling market opportunity.

Identifying the Core Problem

Every strong pitch deck begins with a real, relatable problem. For Branta, that problem is clear: the stress and risk of sending irreversible Bitcoin payments. We all know Bitcoin addresses are long and complex—a simple error can lead to irreversible loss, and fraud is on the rise. My goal? To highlight this pain point sharply and make it resonate.

I leaned into this problem by describing real scenarios where users lose money. It’s specific, impactful, and makes the need for a solution obvious. Key takeaway: Be precise about the problem. It should feel urgent and unavoidable.

The Solution: Simplifying Bitcoin Transactions

Next, I outlined Branta’s solution in a way that feels straightforward and achievable. Branta’s core service is its API, which instantly verifies Bitcoin transactions, removing the need for test transactions and ensuring funds reach the correct recipient.

I broke this solution down into three core benefits:

Instant Verification: No more guessing or testing—users get real-time confirmation.

Error-Free Transactions: Streamlined transactions that save time, fees, and mistakes.

High-Level Security: Branta protects against phishing, fraud, and man-in-the-middle attacks.

For any pitch deck, it’s vital to avoid tech jargon and show the solution in action. Visuals and straightforward explanations go a long way. The result? Investors see exactly how the product works and why it matters.

Imagine sending a high-value Bitcoin transaction—only to find out it went to the wrong address. No customer service, no chargebacks, just irreversible loss. That’s the anxiety gripping the world of crypto transactions today. Enter Branta, a game-changing solution designed to make Bitcoin and Lightning transactions stress-free and secure.

With a pre-seed goal of raising $500,000 at a $5 million valuation, Branta is on a mission to protect users from costly errors and fraud in the fast-growing world of digital finance. This pitch deck doesn’t just present an idea; it lays out a clear solution, backed by a solid revenue model and a surge in demand for Bitcoin verification. Dive in, and you’ll find actionable insights on crafting a pitch deck that speaks directly to investors’ concerns, showcases real-world solutions, and highlights a compelling market opportunity.

Identifying the Core Problem

Every strong pitch deck begins with a real, relatable problem. For Branta, that problem is clear: the stress and risk of sending irreversible Bitcoin payments. We all know Bitcoin addresses are long and complex—a simple error can lead to irreversible loss, and fraud is on the rise. My goal? To highlight this pain point sharply and make it resonate.

I leaned into this problem by describing real scenarios where users lose money. It’s specific, impactful, and makes the need for a solution obvious. Key takeaway: Be precise about the problem. It should feel urgent and unavoidable.

The Solution: Simplifying Bitcoin Transactions

Next, I outlined Branta’s solution in a way that feels straightforward and achievable. Branta’s core service is its API, which instantly verifies Bitcoin transactions, removing the need for test transactions and ensuring funds reach the correct recipient.

I broke this solution down into three core benefits:

Instant Verification: No more guessing or testing—users get real-time confirmation.

Error-Free Transactions: Streamlined transactions that save time, fees, and mistakes.

High-Level Security: Branta protects against phishing, fraud, and man-in-the-middle attacks.

For any pitch deck, it’s vital to avoid tech jargon and show the solution in action. Visuals and straightforward explanations go a long way. The result? Investors see exactly how the product works and why it matters.

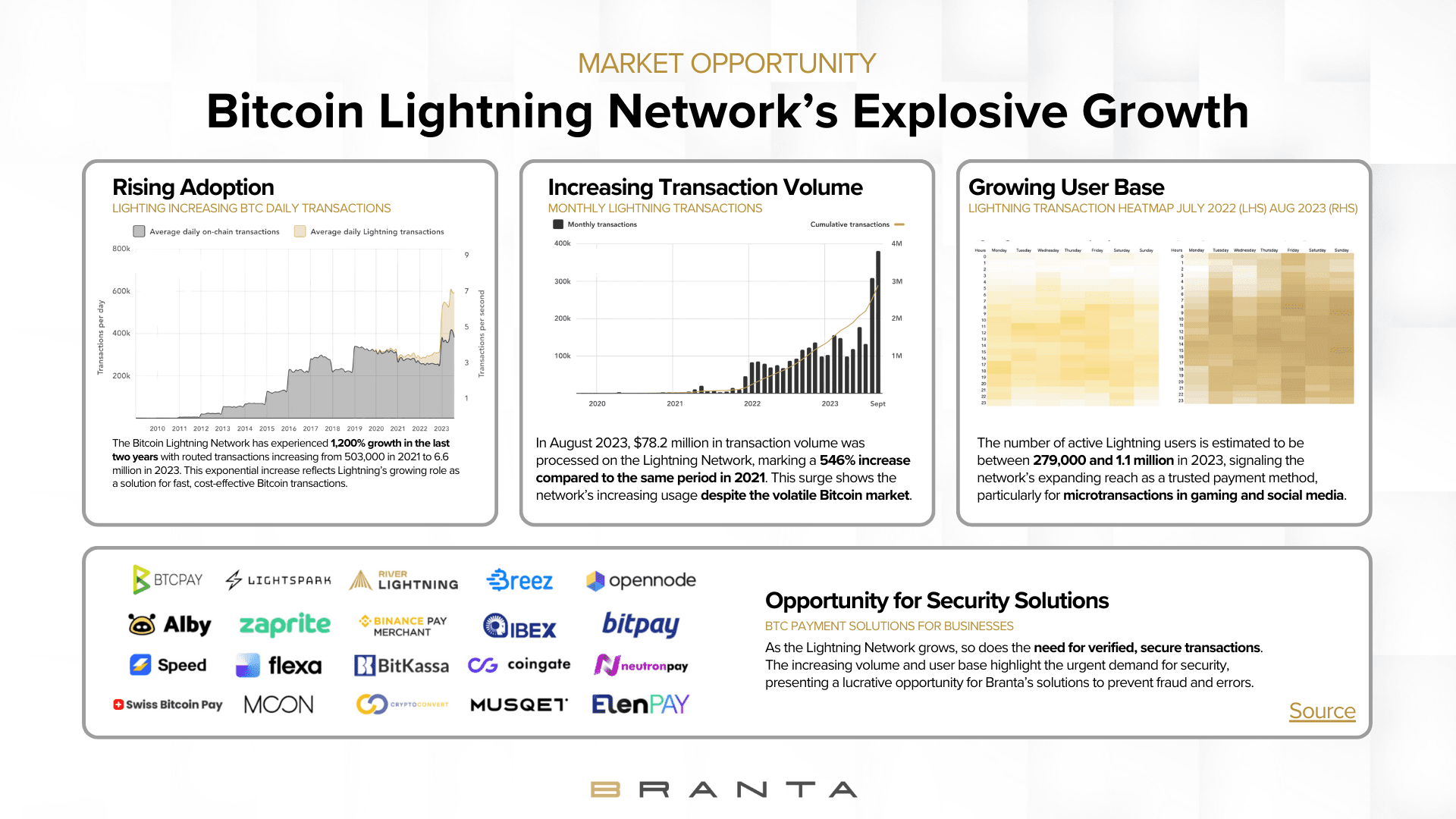

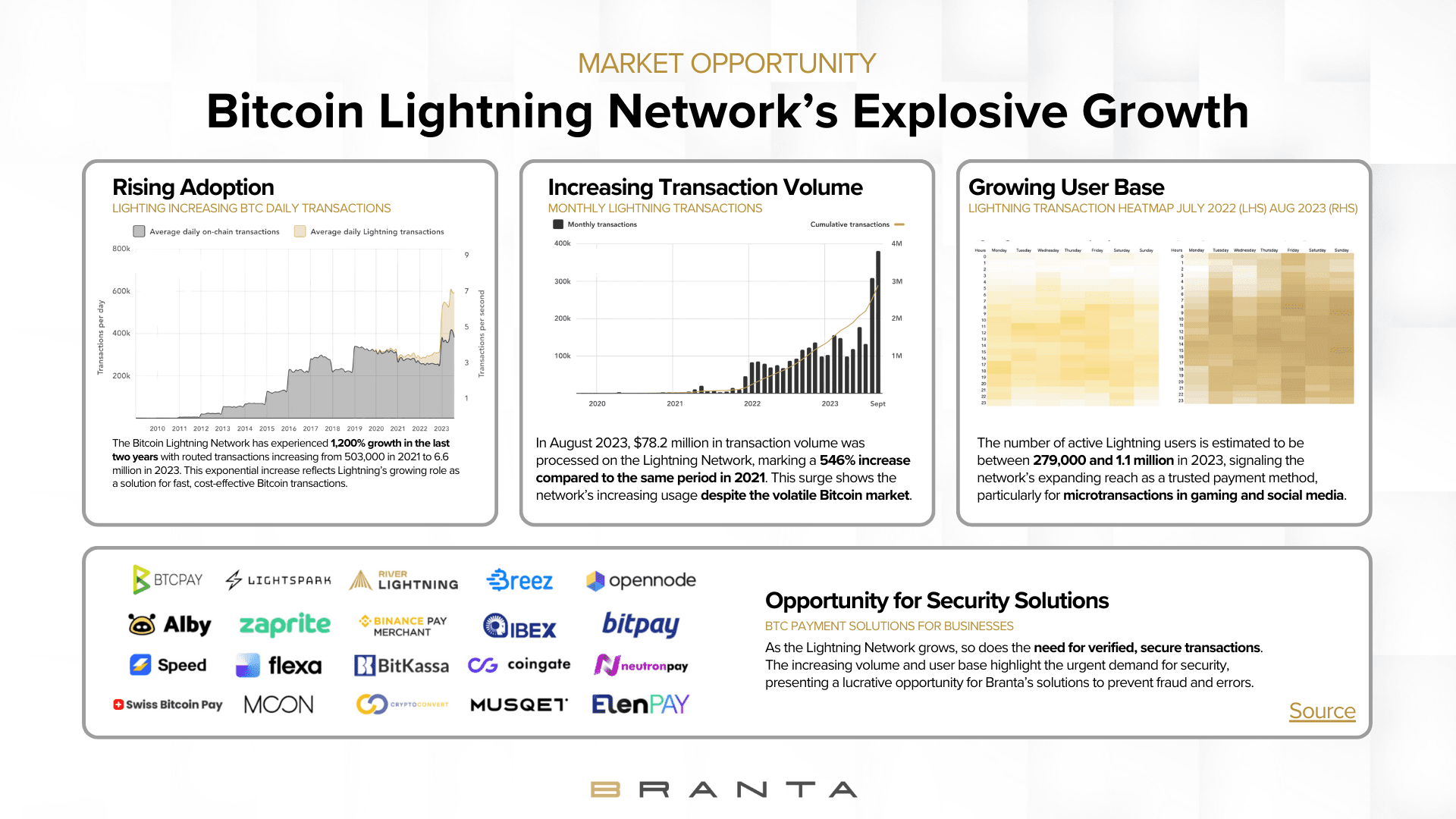

Demonstrating Market Opportunity

Investors want to know that the market is growing and that demand is rising. In Branta’s case, the stats tell a powerful story: as of 2023, the global cryptocurrency market is valued at over $1.5 trillion, and Bitcoin adoption is expected to grow at a CAGR of 25% in the next five years. I used data to connect Branta’s solution with rising Bitcoin adoption, which comes with increased risks of fraud and errors.

Including stats on the rise of Lightning Network transactions, which grew by 546% from 2021 to 2023, underscores the need for secure, verified transactions as Bitcoin usage expands. Key takeaway: When showcasing market opportunity, pick data points that directly tie back to the solution you’re offering.

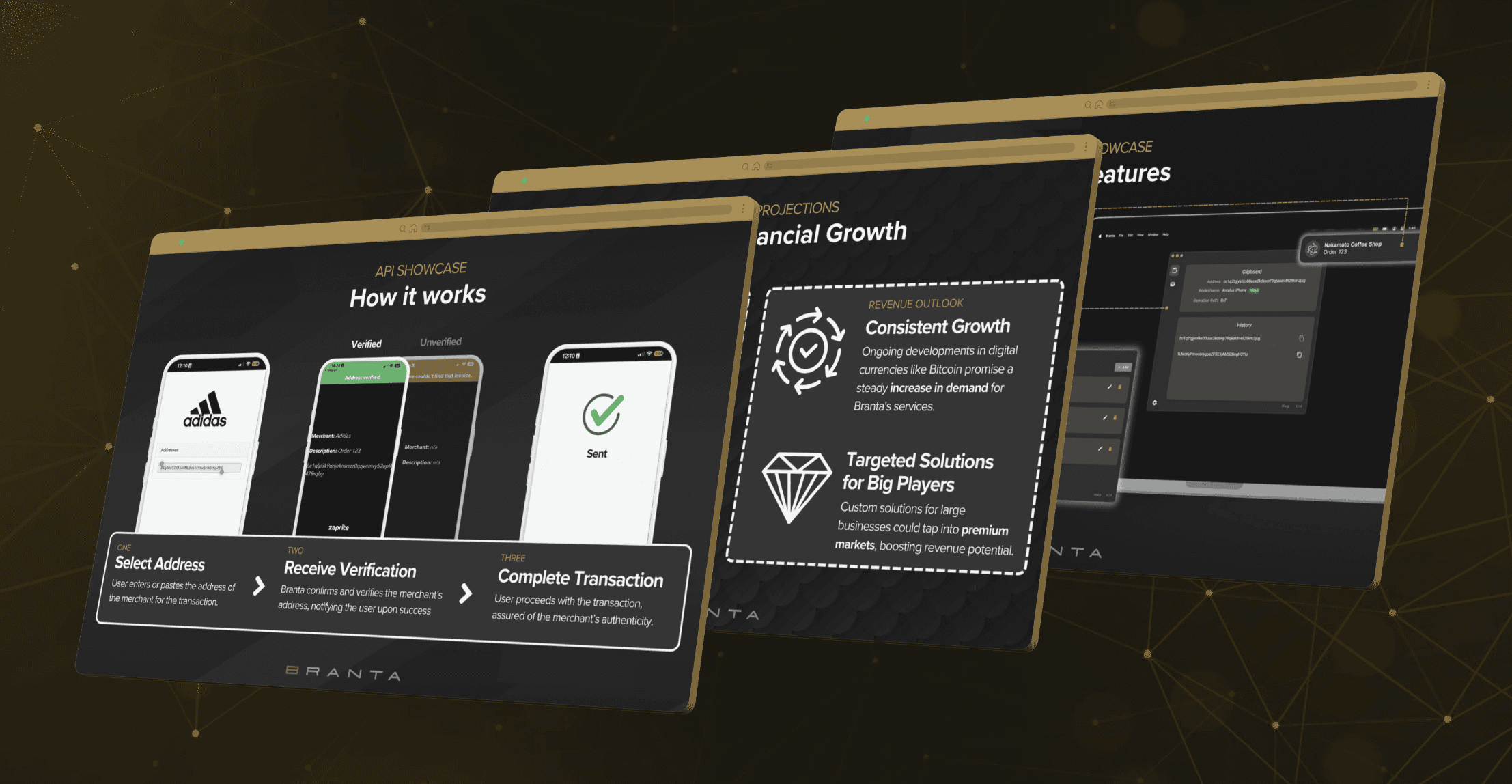

Visualizing the Product and Its Impact

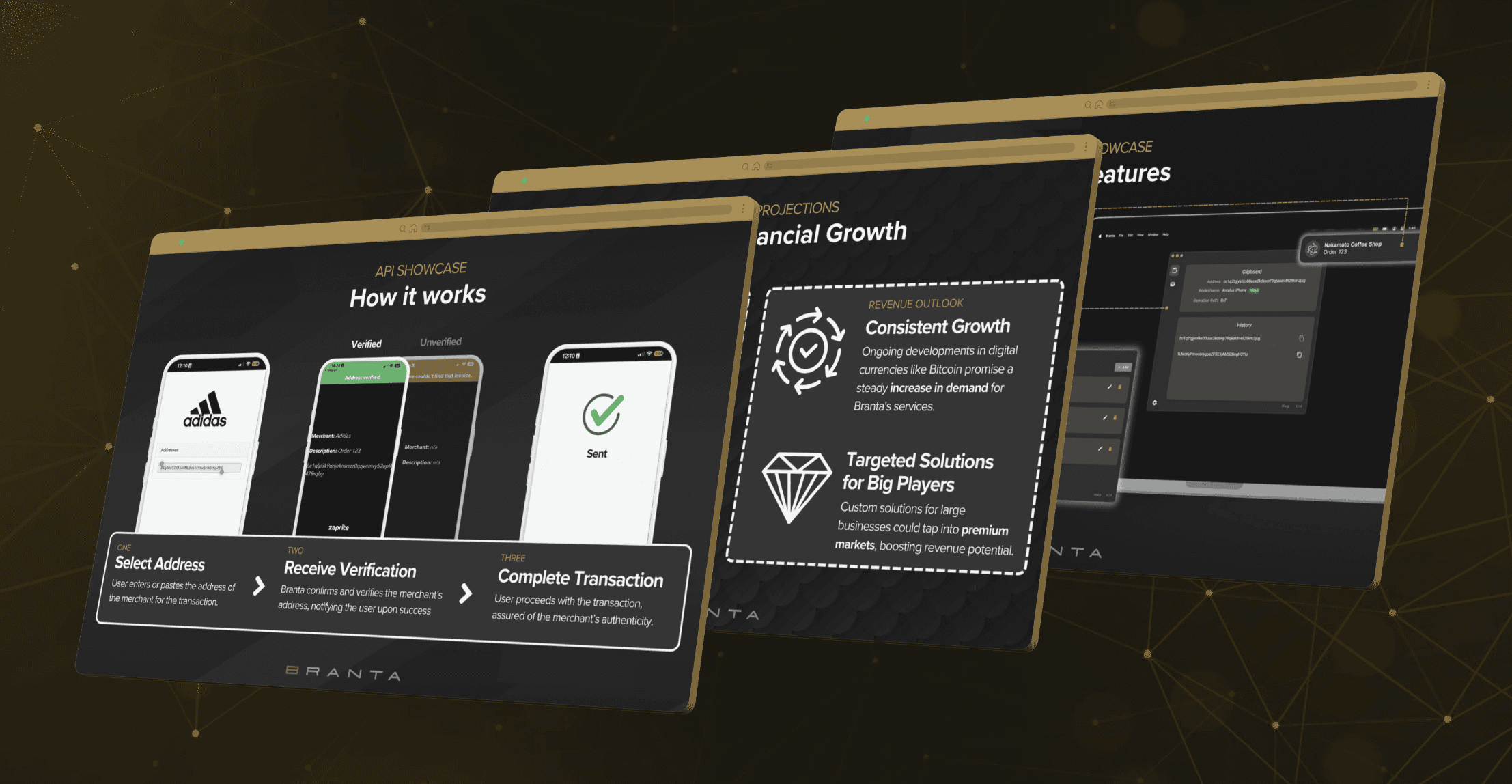

A great pitch deck doesn’t just talk about the product; it shows it. For Branta, I used a simple three-step visual to walk investors through a typical transaction flow:

User enters the recipient’s address.

Branta verifies the address instantly.

User completes the transaction with confidence.

By showing exactly how Branta’s API works, I eliminate ambiguity and emphasize ease of use. Investors don’t just understand the solution—they see it in action, which is key to building credibility and trust.

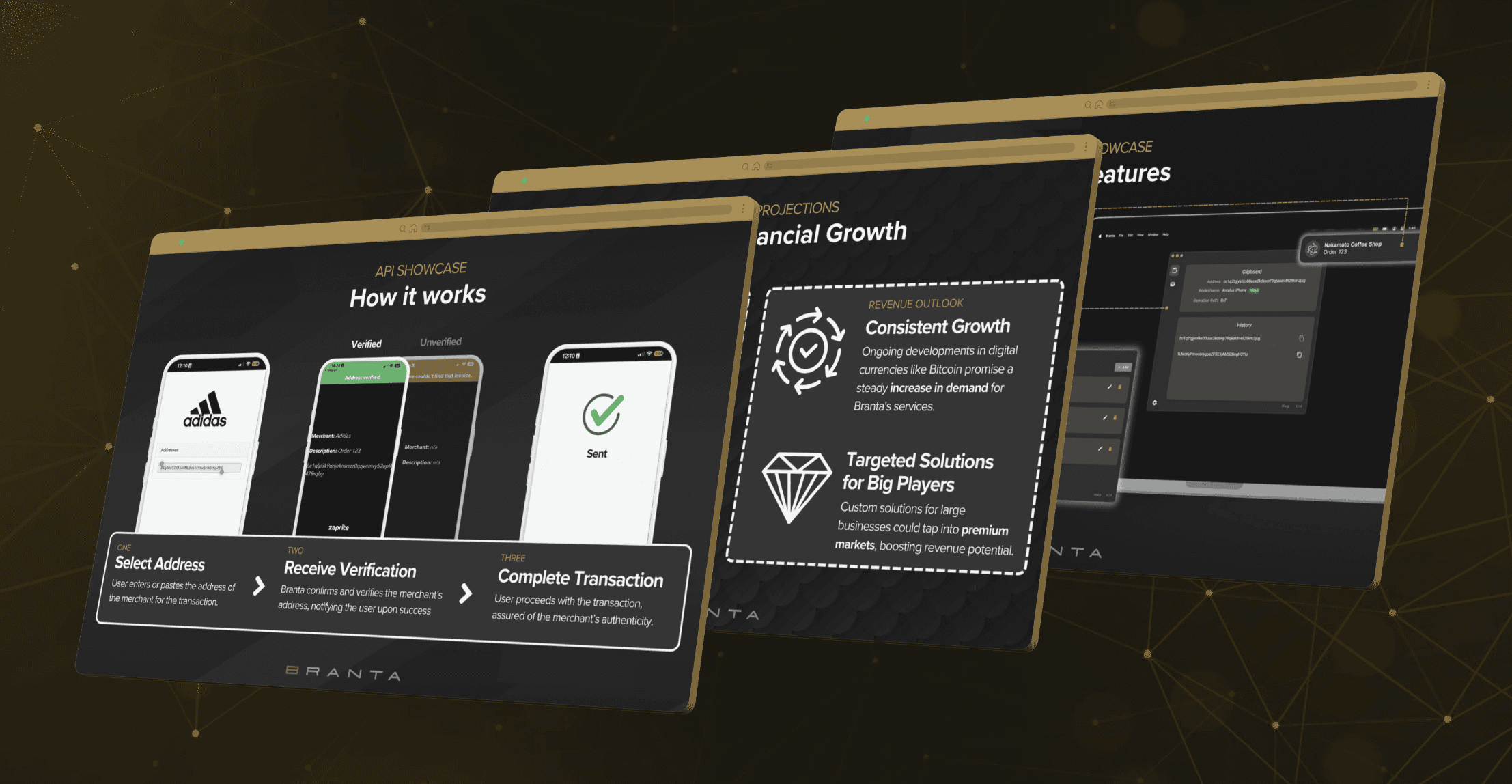

A Solid Business Model: Recurring Revenue That Scales

A game-changing product needs a business model that shows profitability. Branta generates revenue through a subscription model for its API, offering secure transactions as a service to businesses handling Bitcoin payments. The model is simple and scalable, capturing the shift towards subscription-based revenue, which investors appreciate for its predictability.

I positioned this as a core revenue source with potential for expansion, suggesting future opportunities in fraud insurance or consumer protection products as Branta’s user base grows. Key takeaway: Investors love scalable, predictable revenue. A subscription model can make your pitch stronger if it fits your service.

Showcasing the Team

Investors are investing in people as much as the product. Branta’s team includes industry professionals with backgrounds in Bloomberg and advanced engineering. This pitch deck emphasizes the team’s experience to show that Branta has the expertise to scale and adapt. For early-stage companies, showcasing a credible team is often essential to winning investor trust.

Pro tip: Include key players, their backgrounds, and a quick note on what they bring to the project. A well-rounded team with experience can elevate any pitch deck.

Demonstrating Market Opportunity

Investors want to know that the market is growing and that demand is rising. In Branta’s case, the stats tell a powerful story: as of 2023, the global cryptocurrency market is valued at over $1.5 trillion, and Bitcoin adoption is expected to grow at a CAGR of 25% in the next five years. I used data to connect Branta’s solution with rising Bitcoin adoption, which comes with increased risks of fraud and errors.

Including stats on the rise of Lightning Network transactions, which grew by 546% from 2021 to 2023, underscores the need for secure, verified transactions as Bitcoin usage expands. Key takeaway: When showcasing market opportunity, pick data points that directly tie back to the solution you’re offering.

Visualizing the Product and Its Impact

A great pitch deck doesn’t just talk about the product; it shows it. For Branta, I used a simple three-step visual to walk investors through a typical transaction flow:

User enters the recipient’s address.

Branta verifies the address instantly.

User completes the transaction with confidence.

By showing exactly how Branta’s API works, I eliminate ambiguity and emphasize ease of use. Investors don’t just understand the solution—they see it in action, which is key to building credibility and trust.

A Solid Business Model: Recurring Revenue That Scales

A game-changing product needs a business model that shows profitability. Branta generates revenue through a subscription model for its API, offering secure transactions as a service to businesses handling Bitcoin payments. The model is simple and scalable, capturing the shift towards subscription-based revenue, which investors appreciate for its predictability.

I positioned this as a core revenue source with potential for expansion, suggesting future opportunities in fraud insurance or consumer protection products as Branta’s user base grows. Key takeaway: Investors love scalable, predictable revenue. A subscription model can make your pitch stronger if it fits your service.

Showcasing the Team

Investors are investing in people as much as the product. Branta’s team includes industry professionals with backgrounds in Bloomberg and advanced engineering. This pitch deck emphasizes the team’s experience to show that Branta has the expertise to scale and adapt. For early-stage companies, showcasing a credible team is often essential to winning investor trust.

Pro tip: Include key players, their backgrounds, and a quick note on what they bring to the project. A well-rounded team with experience can elevate any pitch deck.

The Financial Ask: Be Specific, Clear, and Reasonable

Branta’s pre-seed round goal is $500,000 at a $5 million valuation. The pitch deck states this clearly and breaks down how funds will be allocated, focusing on expanding market reach, strategic partnerships, R&D, and scaling operations. By being transparent about how the funds will be used, I demonstrate planning and responsibility.

Investors appreciate a specific ask with clear goals for growth. They need to know their investment will be used wisely to push the company forward. Key takeaway: Don’t be vague about your financial ask. Show how the funds will drive growth and make the business sustainable.

Crafting a Pitch Deck That Converts: Lessons from Branta

Start with a Relatable Problem: Make the problem feel real and pressing.

Offer a Clear Solution: Show how the product solves that problem in practical, easy-to-understand terms.

Demonstrate Market Demand: Back up your solution with stats that show the market is not only large but growing.

Show the Product in Action: Use visuals to eliminate any ambiguity about how your product works.

Present a Strong Revenue Model: Make sure your business model is predictable and scalable.

Highlight Your Team: A strong team adds credibility and assures investors of your ability to execute.

Be Clear About Your Ask: Be upfront about your financial needs and how the funds will be used.

With these steps, Branta’s pitch deck aims to secure funding by delivering a clear, engaging, and data-backed narrative. The process showcases how I craft a pitch that speaks directly to investor needs and demonstrates a true understanding of the market.

If you’re looking to create a pitch deck that converts, consider these steps as your blueprint. The journey from concept to investment doesn’t happen overnight, but with a compelling, focused pitch deck, you’re already halfway there.

The Financial Ask: Be Specific, Clear, and Reasonable

Branta’s pre-seed round goal is $500,000 at a $5 million valuation. The pitch deck states this clearly and breaks down how funds will be allocated, focusing on expanding market reach, strategic partnerships, R&D, and scaling operations. By being transparent about how the funds will be used, I demonstrate planning and responsibility.

Investors appreciate a specific ask with clear goals for growth. They need to know their investment will be used wisely to push the company forward. Key takeaway: Don’t be vague about your financial ask. Show how the funds will drive growth and make the business sustainable.

Crafting a Pitch Deck That Converts: Lessons from Branta

Start with a Relatable Problem: Make the problem feel real and pressing.

Offer a Clear Solution: Show how the product solves that problem in practical, easy-to-understand terms.

Demonstrate Market Demand: Back up your solution with stats that show the market is not only large but growing.

Show the Product in Action: Use visuals to eliminate any ambiguity about how your product works.

Present a Strong Revenue Model: Make sure your business model is predictable and scalable.

Highlight Your Team: A strong team adds credibility and assures investors of your ability to execute.

Be Clear About Your Ask: Be upfront about your financial needs and how the funds will be used.

With these steps, Branta’s pitch deck aims to secure funding by delivering a clear, engaging, and data-backed narrative. The process showcases how I craft a pitch that speaks directly to investor needs and demonstrates a true understanding of the market.

If you’re looking to create a pitch deck that converts, consider these steps as your blueprint. The journey from concept to investment doesn’t happen overnight, but with a compelling, focused pitch deck, you’re already halfway there.

The Financial Ask: Be Specific, Clear, and Reasonable

Branta’s pre-seed round goal is $500,000 at a $5 million valuation. The pitch deck states this clearly and breaks down how funds will be allocated, focusing on expanding market reach, strategic partnerships, R&D, and scaling operations. By being transparent about how the funds will be used, I demonstrate planning and responsibility.

Investors appreciate a specific ask with clear goals for growth. They need to know their investment will be used wisely to push the company forward. Key takeaway: Don’t be vague about your financial ask. Show how the funds will drive growth and make the business sustainable.

Crafting a Pitch Deck That Converts: Lessons from Branta

Start with a Relatable Problem: Make the problem feel real and pressing.

Offer a Clear Solution: Show how the product solves that problem in practical, easy-to-understand terms.

Demonstrate Market Demand: Back up your solution with stats that show the market is not only large but growing.

Show the Product in Action: Use visuals to eliminate any ambiguity about how your product works.

Present a Strong Revenue Model: Make sure your business model is predictable and scalable.

Highlight Your Team: A strong team adds credibility and assures investors of your ability to execute.

Be Clear About Your Ask: Be upfront about your financial needs and how the funds will be used.

With these steps, Branta’s pitch deck aims to secure funding by delivering a clear, engaging, and data-backed narrative. The process showcases how I craft a pitch that speaks directly to investor needs and demonstrates a true understanding of the market.

If you’re looking to create a pitch deck that converts, consider these steps as your blueprint. The journey from concept to investment doesn’t happen overnight, but with a compelling, focused pitch deck, you’re already halfway there.

Industry

Cyber Security

Industry

Cyber Security

Duration

2 weeks

Duration

2 weeks

OTHER PROJECTS

OTHER PROJECTS

Let's get to know each other.

Book your call below.

Let's get to know each other.

Book your call below.

Let's get to know each other.

Book your call below.

Kenneth Pesaitis | Powered by Tenxent

© 2024 Tenxent. All Rights Reserved.

Kenneth Pesaitis | Powered by Tenxent

© 2024 Tenxent. All Rights Reserved.

Kenneth Pesaitis | Powered by Tenxent

© 2024 Tenxent. All Rights Reserved.